- Sale in cash to a customer, this is like when you go to shop and buy goods in exchange for money.

- Sale on credit to a customer. Credit salesare allowances of goods to customers in order to pay in advance.The name speaks for itself. It is goods given to a customer oncredit, meaning that you sell the goods and collect cash at a later date per agreement with customer

- Receive cash in payment of an invoice owed by a customer. This is mostly used consultations nowadays. example, some one may be working to provide her skills on a project and she wrote an invoice to ask for payment after the end of the project. Import and exports use this kind of transaction too.

- Purchase fixed assets from a supplier

- Record the depreciation of a fixed asset over time

- Purchase consumable supplies from a supplier

- Investment in another business

- Investment in marketable securities

- Engaging in a hedge to mitigate the effects of an unfavorable price change

- Borrow funds from a lender

- Issue a dividend to investors

- Sale of assets to a third party

- Transactions are the building blocks of our accounts. Any transactions that occur within our business should be present in our accounting records.

- There are many different types of transactions to keep track of such as sales, purchases, and even more. A regular point of confusion that we come across when we talk to small businesses about their accounts is the difference between cash and credit transactions. So, what is the difference?

- The only difference between cash and credit transactions is the timing of the payment. A cash transaction is a transaction where payment is settled immediately. On the other hand, payment for a credit transaction is settled at a later date.

- Try not to think about cash and credit transactions in terms of how they were paid, but rather, when they were paid. For example, you may buy some groceries at your local shop and pay for them in cash there and then, that’s a cash transaction. However, what if you paid by card rather than cash? That can also be classified as a cash transaction because you paid immediately.

- On the other hand, credit transactions are paid at a later date than when the exchange of goods or services took place and almost all of time an invoice for the transaction is issued. The time period before payment can vary depending on the types of businesses or even the industry in which the transaction is taking place. Once again, when payment is finally settled for the invoice, it may be done with cash or card, or any other payment method but it is still a credit transaction.

- Businesses will have a mixture of cash and credit transactions make up their accounting records. Some businesses may have the majority of their transactions be either one or the other and some will have a more even split. However, you would be hard pressed to find a business that didn’t have at least one cash or credit transaction occur during its lifetime.

- Along with whether a transaction is classified as cash or credit another category is used to classify basic accounting transactions. We also need to know whether or not it is a sale, purchase or payment. This gives us a list of basic transactions:

- 1. Cash sale

- Some of these, like cash and credit sales as well as credit purchases are more common that the others but depending on what type of transaction we have, we can find a home for it in our accounts.

- Cash and Cash Equivalents – bills, coins, funds for current purposes, checks, cash in bank, etc.

- Receivables – Accounts Receivable (receivable from customers), Notes Receivable (receivables supported by promissory notes), Rent Receivable, Interest Receivable, Due from Employees (or Advances to Employees), and other claims

- Inventories – assets held for sale in the ordinary course of business

- Prepaid expenses – expenses paid in advance, such as, Prepaid Rent, Prepaid Insurance, Prepaid Advertising, and Office Supplies

- Long-term investments – investments for long-term purposes such as investment in stocks, bonds, and properties; and funds set up for long-term purposes

- Land – land area owned for business operations (not for sale)

- Building – such as office building, factory, warehouse, or store

- Equipment – Machinery, Furniture and Fixtures (shelves, tables, chairs, etc.), Office Equipment, Computer Equipment, Delivery Equipment, and others

- Intangibles – long-term assets with no physical substance, such as goodwill, patent, copyright, trademark, etc.

- Other long-term assets

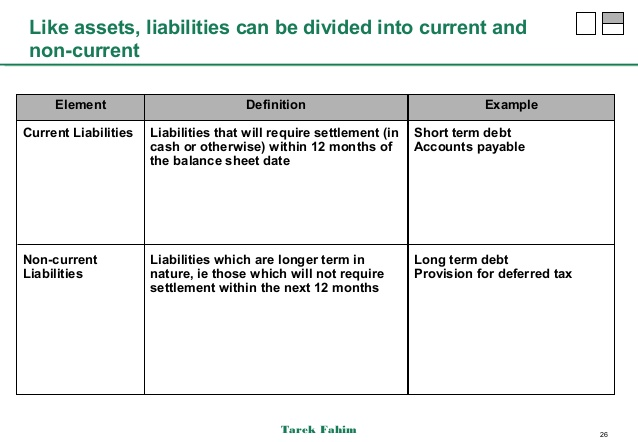

- Trade and other payables – such as Accounts Payable, Notes Payable, Interest Payable, Rent Payable, Accrued Expenses, etc.

- Current provisions – estimated short-term liabilities that are probable and can be measured reliably

- Short-term borrowings – financing arrangements, credit arrangements or loans that are short-term in nature

- Current tax liabilities – taxes for the period and are currently payable

- Current-portion of a long-term liability – the portion of a long-term borrowing that is currently due.

- Long-term notes, bonds, and mortgage payables;

- Deferred tax liabilities; and

- Other long-term obligations

- Initial and additional contributions of owner/s (investments),

- Withdrawals made by owner/s (dividends for corporations),

- Income, and

- Expenses.