SUBJECT MATTER OF BOOK KEEPING

- Billing for goods sold or services provided to clients.

- Recording receipts from customers.

- Verifying and recording invoices from suppliers.

- Paying suppliers.

- Processing employees’ pay and the related governmental reports.

- Monitoring individualaccounts receivable.

- Recording depreciation and other adjusting entries.

- Providing financial reports.

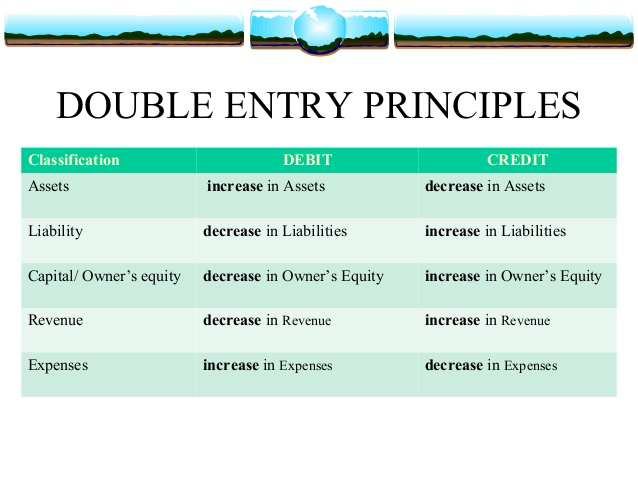

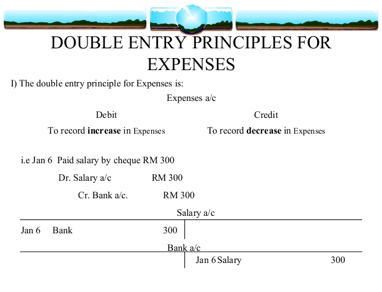

- Adebitis an accounting entry that either increases an asset or expense account, or decreases a liability or equity account. It is positioned to the left in an accounting entry.

- Acreditis an accounting entry that either increases a liability or equity account, or decreases an asset or expense account. It is positioned to the right in an accounting entry.

- Ascertainment of result of operation: Bookkeeping is intended to the ascertainment of the result of operation i.e the profit/loss of a firm or company by recoding all the revenue income and gains and expenses and losses of a certain period and by comparing them. It is ascertained by preparing the income statement or profit and loss account at the end of each fiscal year.

- Ascertainment of the financial position: It helps to ascertain the financial position of a firm or company by recording the appropriate values of different types of assets, specially in its net cost, and the capital and liabilities up to the date. It is found by preparing the balance sheet at the close of the fiscal year.

- Maintaining control over the assets and budget: Bookkeeping maintains control on the assets, income and expenses of all types by making their complete records. It helps one to see how efficiently the assets are utilized and the budget is disposed off. Thus, it establishes financial discipline by controlling frauds on budget and its expenditure.

- Prediction of the volume of cash for future: Bookkeeping helps the future forecast of cast by verifying the receipt and payments of an organization and the proposed expansion programmes. Specially, it is important to those whole financial system is based upon cash budget

- Importance to the professional and other individuals: Book keeping is important to the professionals like doctors, engineer, mechanics, lawyer, auditor etc. for recording their incomes and expenses and profits and losses etc. regularly and systematically for controlling expenses and gaining income. Similarly, it is important to the general people for making a proper balance of their income and expenses for their personal house hold affairs.

- Important to business organizations: Book keeping is essentially important to a business organization for keeping the complete records of the transactions. It is important, specially to determine the result of operation, financial position, controlling assets and other resources, establishing financial discipline, assessing tax liabilities etc.

- Importance to the government: Book keeping is important to the government to evaluate the progress of the government projects, to collect necessary statements, data and information for the preparation of government budget, to control over the leakage, misuse and misappropriation of budget etc. of the government property and resources.

- Important to other parties: Book keeping is equally important to the financial analysts and other interested parties like investors, creditors, banks, customers etc. to study and analyze the different financial statements of a certain firm or company. It is also important to the job seekers for better opportunity for getting employment.

- Increase in assets

- Increase in expense

- Decrease in liability

- Decrease in equity

- Decrease in income

- Decrease in assets

- Decrease in expense

- Increase in liability

- Increase in equity

- Increase in income

- DEBIT SIDE-is the left side of an account

- CREDIT SIDE-is the rightside of an account.